Wrapping Up a Decade

2 min read

As the decade comes to a close, it is a great time to reflect back on what actually happened in the market compared to what we thought would happen. If there’s one thing that saw an overabundance of forecasting in the past 10 years, it’s retail. From predictions of a “retail apocalypse” to prophesies of augmented reality experiences at brick and mortar locations, the crystal ball has been decidedly foggy.

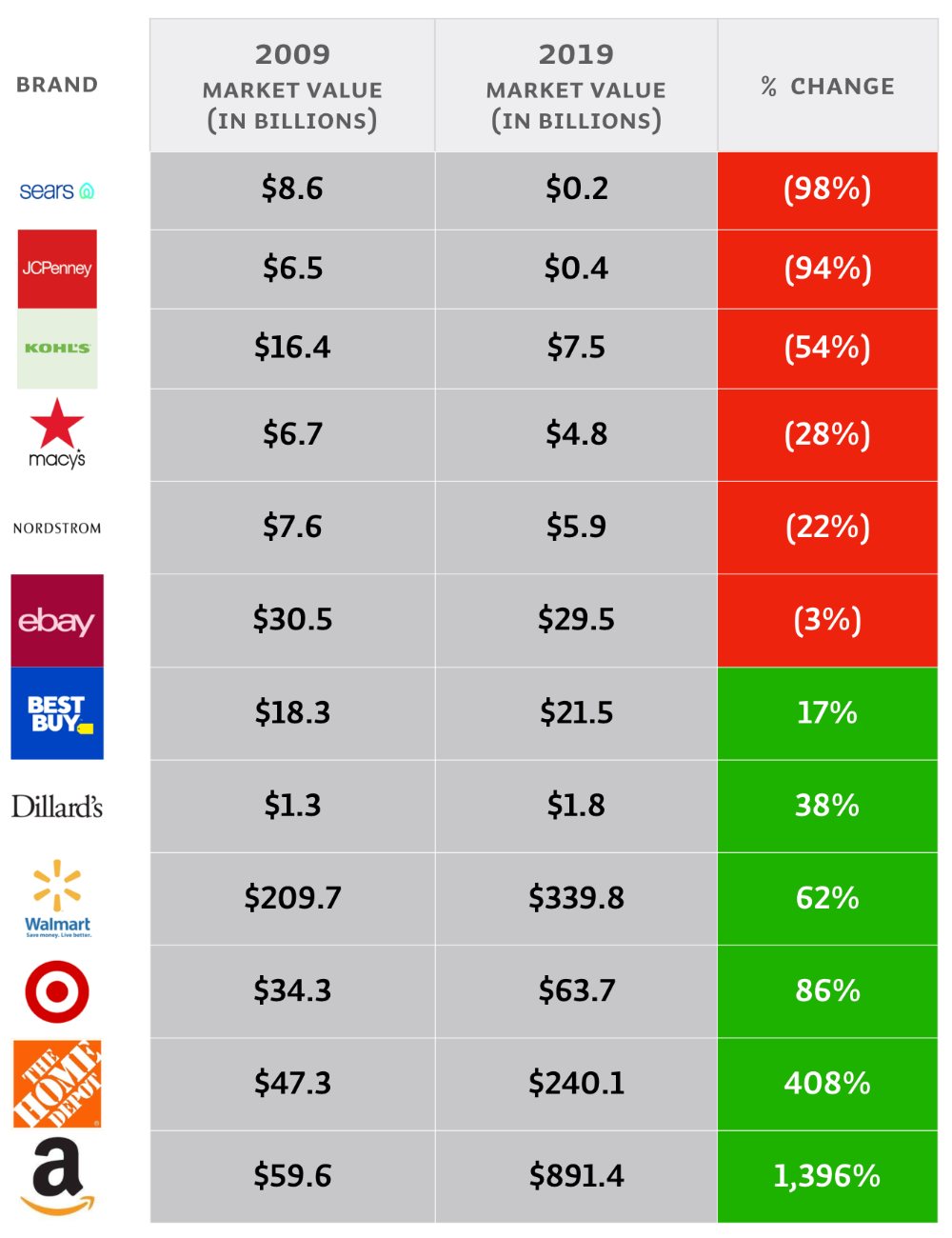

The greatest concern of the decade has been the fate of big box stores in their survival against the e-commerce platforms. We were curious to see who were the winners and losers this decade. Unsurprisingly the e-commerce behemoth Amazon has become king, seeing an increase in market value of 1,396% since 2009. That's astonishing! Think about any business growing from $60 billion to almost $900 billion in 10 years, that's Amazon's growth. Walmart has continued to see growth—a modest 62% with a solid market value of $339.8 billion. However, department stores—like Sears and JCPenney—have struggled to stay alive, dipping down lower and lower and lower in value. Call it "Retail Darwinism," they have failed to adapt to dynamic market forces and will likely die.

Amazon has become omnipresent in the marketplace during this decade. It's hard to believe they were once a challenger brand, the insurgent, selling only books. Now they are the juggernaut where once Walmart ruled the terms of this consumer dominance. Bezos's long-range vision is paying off.

Beyond Amazon's incredible growth, to us the biggest surprises were Home Depot, Target, and Best Buy. They are fighting the hardest to stay relevant, and they are growing. What has driven them to growth while others around them seem to be going by the wayside? It all lies in how they have adjusted to the new marketplace.

Number one is syncing up their retail and online experiences for convenience, such as the ability to order online followed by curbside pickup (Target) or locker pickup (Home Depot) at the local store. As for getting guests to physically come into the store, retailers have been testing several tactics. Target has continued to improve their apparel store brands, like Universal Thread and Goodfellow & Co., to be both desirable and affordable. They have also focused on their toy offerings—in October of this year they opened Disney stores within 25 of their stores. All three have the retailers have begun training employees to be more knowledgable in certain product categories, so they can be more helpful to customers in that department. Heck, even Kohl's is working hard to get customers in the door—they now handle Amazon returns at all of their locations. Brilliant. Offer customers something of value and get them in your store.

There are profound winners and losers in retail the past ten years, and we look forward to seeing how it morphs further in the next decade. What will this chart look like in 2029? How does this compare with your shopping habits? Are you more of an Amazon online-only shopper, or do you like to physically visit the stores? And why?